|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

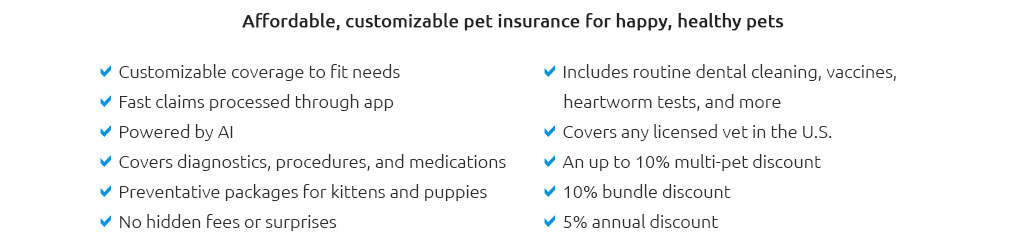

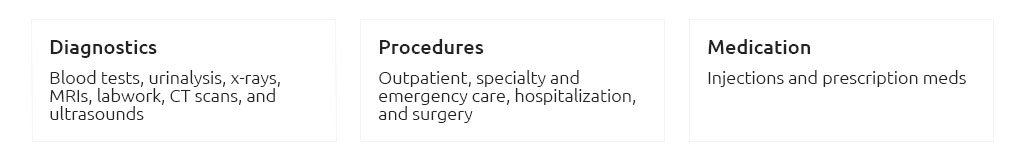

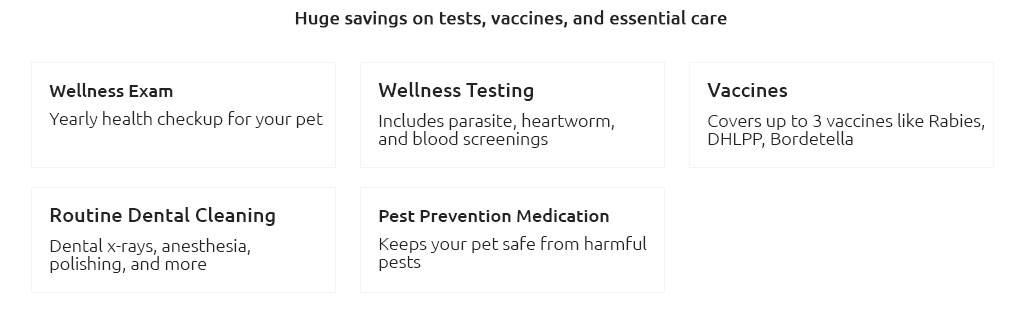

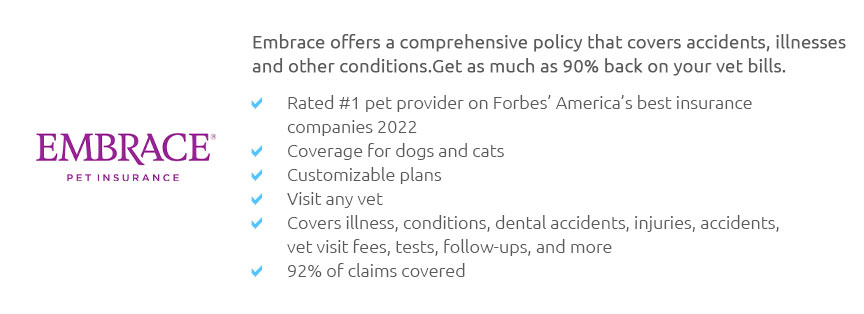

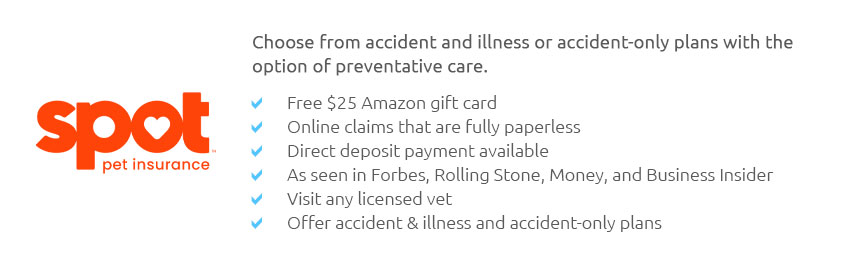

Understanding Pet Insurance for Wellness and Maintaining Pet HealthPet insurance for wellness is a valuable tool for pet owners looking to ensure their furry friends remain healthy and happy. This type of insurance typically covers routine care, preventive measures, and sometimes even unexpected health issues. By investing in a wellness plan, you can help your pet live a longer and healthier life. What is Pet Wellness Insurance?Pet wellness insurance focuses on preventive care rather than treating illnesses or injuries after they occur. This type of insurance can cover routine check-ups, vaccinations, and regular screenings. Key Benefits

Common Mistakes to AvoidWhen choosing pet insurance for wellness, pet owners often make some avoidable errors. Not Researching ThoroughlyIt's crucial to understand what is covered under a wellness plan. Some plans may not cover all necessary procedures, leading to unexpected costs. For example, if you have an older pet, you might also want to consider pet insurance for elderly cats to ensure comprehensive coverage. Overlooking Existing ConditionsMost wellness plans do not cover pre-existing conditions. If your pet has a health issue, you should look into options like pet insurance for existing injury to ensure they get the care they need. FAQ SectionWhat does pet wellness insurance typically cover?Pet wellness insurance often covers routine check-ups, vaccinations, flea and tick prevention, and sometimes dental care. Is pet wellness insurance worth the cost?If you are committed to regular preventive care, pet wellness insurance can save you money in the long run by covering routine costs. Can I combine wellness insurance with other pet insurance plans?Yes, many providers offer add-ons to existing plans or bundled packages that include wellness coverage along with accident and illness protection. https://www.petinsurance.com/petwellness/

From routine check-ups and vaccinations to dental cleanings and flea control, tailor your routine care insurance plan to cover what you need to keep your pet ... https://www.banfield.com/products/optimum-wellness-plan

Your pet's OWP helps make petcare easier. With insurance, you pay a premium and hope your pet's services are reimbursed. With an OWP, you pay in monthly or ... https://www.akcpetinsurance.com/plans/pet-wellness-coverage

Pet wellness plans offer reimbursement for routine screenings and preventive care to help keep your cat or dog healthy.

|